University of Wisconsin’s Institute for Research on Poverty, also known as IRP, continued its 2021-22 seminar series Thursday with a presentation on the effects of negative income taxes.

The seminar, titled “Welfare vs Work Under a Negative Income Tax: Evidence from the Gary, Seattle, Denver, and Manitoba Income Maintenance Experiments,” was hosted by University of Waterloo Associate Professor of Economics Chris Riddell.

Professor Riddell is a “social scientist with wide interests.” His current research addresses issues around the labor market and social policy.

The IRP is devoted to understanding socioeconomic factors related to poverty by bringing together social scientists from across research disciplines such as economics, sociology, social work and demography.

In the presentation, Riddell explained that a negative income tax is a form of basic income guarantee and was proposed by some economists, such as Milton Friedman, in the ’60s and ’70s.

Universal Basic Income an ideal replacement for a broken welfare system,

Riddell presented data from four income maintenance experiments, or IMEs, which were conducted in Indiana, Washington, Colorado and the Canadian province of Manitoba.

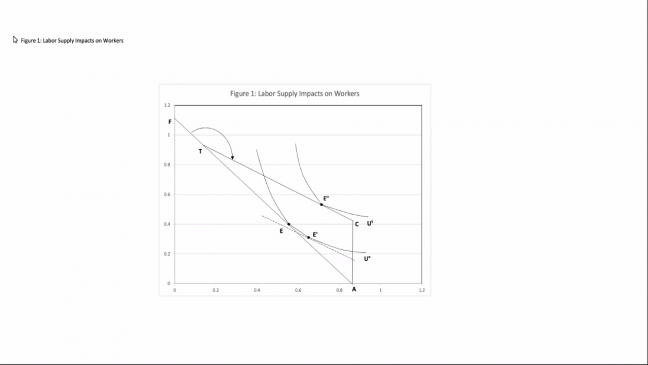

According to Riddell, many economists in the past believed guaranteeing people income through a negative income tax would reduce work effort and cause a reduction in the labor supply. Riddell used data from single mothers who received income through these IMEs to explain that belief is untrue.

“Overall, we find no support for the consensus view that single moms reduced work effort,” Riddell said.

Riddell showed the differences in responses depending on what groups received this income guarantee. The working poor, specifically those not on welfare, substituted leisure for work as their income increased.

Welfare recipients increased their work effort when they received a negative income tax.

“Labor supply responses of the smaller welfare group and large worker group approximately offset each other,” Riddell said.

UW emergency pandemic aid creates equity, could use more vetting

Riddell said he wants his graduate students to follow in his footsteps and analyze these old experiments to better understand guaranteed basic income policies.

Previous IRP seminars featured guests such as University of Pennsylvania Assistant Professor Amy Castro Baker, the Co-Founder and Director of the Center for Guaranteed Income Research.