Catherine Proscia is a die-hard Badger fan. Her room is lined with University of Wisconsin

sports team posters, her favorite shirt is bright red with “University of Wisconsin Badgers”

printed across the chest and every day on her drive to work, a miniature Bucky Badger dangles

from the key chain at the side of her steering wheel.

Upon first stepping foot on the UW campus, Proscia fell in love with the university and said she

would do anything to be admitted. A few months later, she received her acceptance letter in the

mail.

“I know it sounds cheesy, but I really feel like I was meant to go there,” Proscia said. “I feel like

it was a big ‘ole happy family. Everybody is proud to be a Badger. Once you’re a Badger, you’re

always a Badger.”

But even with Badger spirit streaming from her pores, Proscia finds herself 100 miles to the southeast, in DeKalb, Ill.

Proscia, a native of Rockford, Ill., is responsible for paying for her entire college experience

herself. With tuition hikes and proposals to further stretch costs for out-of-state students, Proscia

was forced to leave her friends, education and “dream school” behind.

In the middle of her sophomore year at UW, Proscia transferred to Northern Illinois University,

a school where she can pay in-state tuition that equates to one-fourth of the cost of out-of-state

tuition at UW.

Even after holding two jobs and transferring to a less-expensive school, Proscia has nine loans to

her name and is still almost $40,000 in debt from her UW education alone.

“I [could not] keep doing this to myself,” Proscia said. “There is no guarantee when I get out of

school that I will get a good job and be able to pay this off.”

But the dwindling job market is not what scared Proscia into foregoing her UW education.

“The only reason I left was the money,” she said. “It sucks it had to be that way, but I cannot

afford to be $150,000 in debt before I am making any money.”

The Madison Initiative for Undergraduates

Over the past two years, UW students have seen a dramatic increase in tuition as part of the

Madison Initiative for Undergraduates. The initiative increases in-state tuition by $250 and out-of-state tuition by $750 per year over a four-year period of time.

Original projections from the MIU budget estimate $20.4 million dollars will be distributed for

financial aid use by 2013.

But many students are not given need-based aid because their parents’ income disqualifies them,

though they are expected to pay for college on their own.

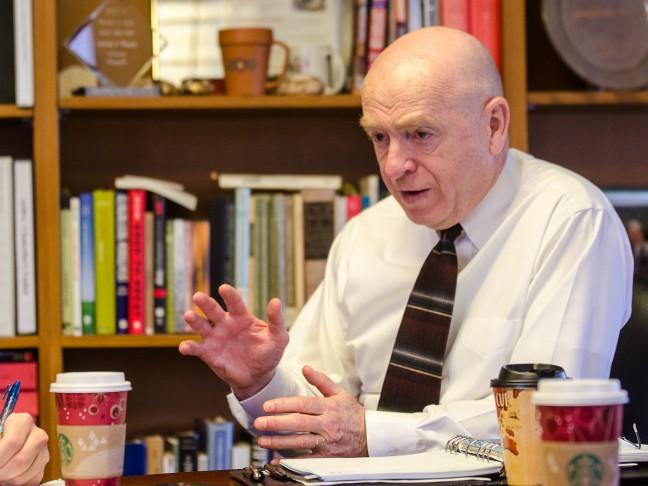

“Family contributions are a key part of the financing of higher [education],” Chancellor Biddy

Martin wrote in an e-mail. “Students who do not qualify for financial aid, but also do not receive

adequate support from their families, are in a very difficult position.”

Proscia is one of many in this “difficult position.” Although Proscia’s stepfather makes enough

money to pay for her tuition, Proscia is the eldest of six children and her parents are unwilling to

pay for her advanced education.

Proscia’s father, who is only fiscally responsible for Proscia and her younger brother, also

refuses to financially support her. The only “help” Proscia receives is when her mother picks up

the tab for a grocery bill once every few months.

“My friend just bought a computer because he had extra financial aid. I’m sitting here with

zero and I’m completely in debt,” Proscia said. “It makes me upset with how the whole system

works. Can’t they see all their loans I’m taking out? If my parents were helping me, I obviously

wouldn’t have to take out all these loans.”

Still in Debt

The university does provide financial support to out-of-state students.

According to UW’s 2009-2010 Data Digest, scholarship funding has increased by approximately

$39.2 million over the past decade.

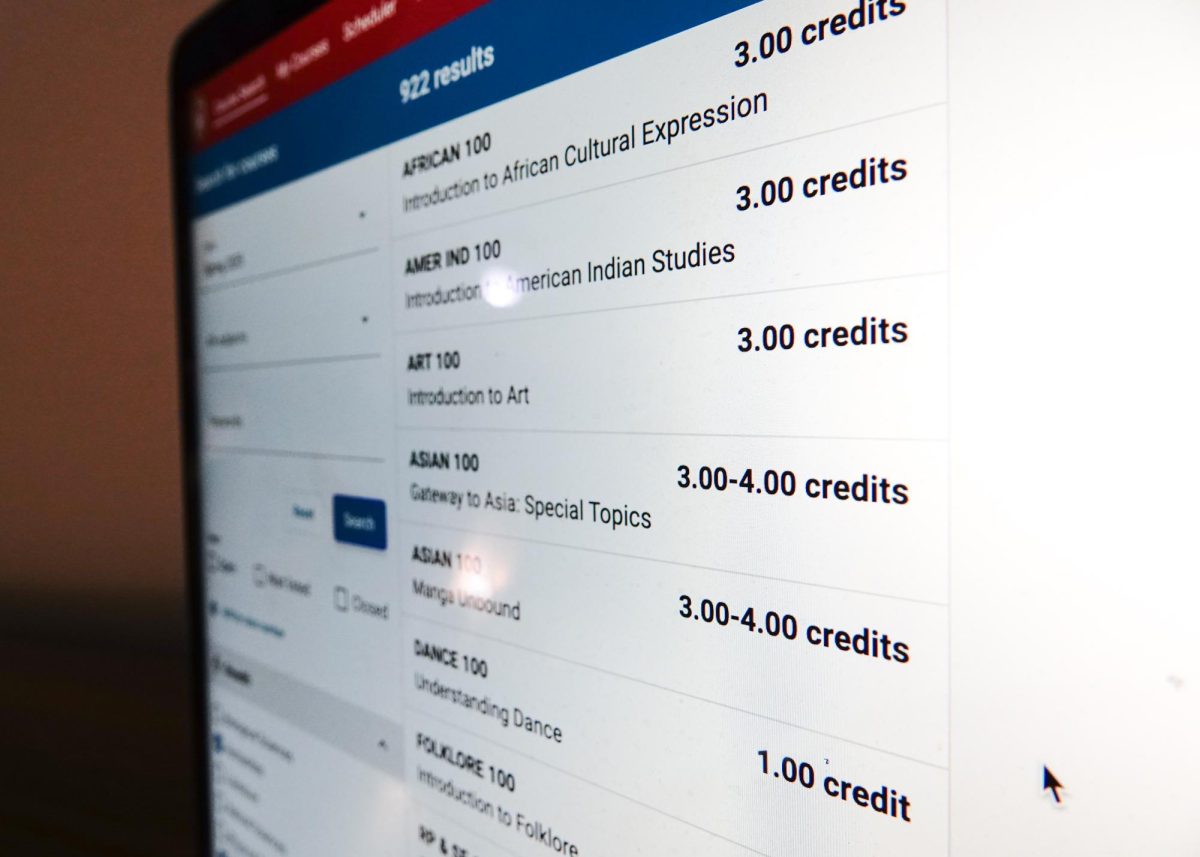

This May, Martin also announced the approval of an MIU proposal that allocates $660,000

one-time funds to Scholarships@UW-Madison to help implement the online undergraduate

scholarship application system.

But even if a student is lucky enough to be awarded a scholarship, it only slightly eases the

financial wounds inflicted by college tuition.

From 2002 to 2009, UW graduates’ debt increased from 43.3 percent to 48.1 percent, according to

UW data.

Martin said there are a variety of reasons for increased student debt, not all of them negative.

“Tuition increases are among [reasons for increased debt]. There are also different perspectives

on the average amount of debt with which students graduate,” Martin wrote. “Some people see

it as a crisis. Others believe the return on investment for degree holders – in earnings, health

outcomes, etc. – makes the average debt at graduation a reasonable responsibility.”

To some extent, Sean Madden, a UW junior from Lincolnshire, Ill., agrees.

“It’s frustrating because [my home in Illinois] is closer to Madison than other people in the state,

geographically speaking, yet I have to pay so much more,” Madden said. “But still, compared to

other private institutions, Madison is relatively cheap.”

As a public university sponsored by the state, UW is geared toward the interests of the people

in that state, Madden said. UW is under the impression that many of the people who grow up in

Wisconsin will go to school and continue to reside in Wisconsin.

As a non-resident UW student, Madden said he is pretty fortunate. His parents, with the help of

an outside program, are capable of paying out-of-state tuition.

Yet Madden assumes UW merit-based scholarships are also geared toward Wisconsin natives.

Despite applying for dozens, Madden, who has a 3.8 grade point average, has yet to be awarded

one.

The New Badger Partnership

The New Badger Partnership would allow UW to continue serving the state without relying so

heavily on state funding. Currently, state funding for UW is approximately 19 percent of the

university’s total budget.

“I want to move it forward because we will almost certainly lose even more state funding in the

next biennial budget,” Martin wrote in an e-mail. “We need tools that will allow us to continue

supporting our faculty, staff and students, providing them with the infrastructure and resources

that will attract and keep them here, ensure quality and preserve the value of our students’

degrees.”

Although the plan is vague, Martin strongly emphasized that the arrangement with the state

would still preserve the UW’s public status and mission, but allow university administration to

have freer reign on operational and monetary activities.

But Martin may have trouble getting the New Badger Partnership approved by the Board of

Regents.

In late November, Rep. Steve Nass, R-Whitewater, was named chairman of the Assembly

Colleges and Universities Committee for the 2011-12 legislative session. According to Nass

spokesperson Mike Mikalsen, Martin is waiting for the new Legislature to be seated before she

discloses the details of her plan, but in general, Nass does not find her call for higher tuition

effective.

“He is not going to support dramatically increasing tuition and pricing Wisconsin families out of

a college education,” Mikalsen said.

Wisconsin’s need-based programs are wonderful, except most middle class families do not

qualify for them and barely qualify for the federally subsidized loan programs, Mikalsen

said. Part of Martin’s plan would call for even higher levels of tuition than the current 5.5

percent increase per year. This will price many Wisconsin families out of the market for a UW

education.

Nass plans to introduce legislation this year that would cap the amount of tuition and mandatory

fees that can be raised for UW System students. This tuition cap will only apply to resident

students’ tuition, Mikalsen added. Currently non-resident students must pay 105 percent of the

cost of the UW academic education they receive.

“It is very difficult to encourage more out-of-state students to come (to UW) because we are

keeping out many of our best and brightest (resident) students who cannot get into UW-

Madison,” Mikalsen said, adding the UW System currently caps the number of non-resident

students admitted at 25 percent.

Given “diminishing state support,” the burden on tuition and other sources of revenue has

greatened, Martin said.

“The university loses whenever any student feels he or she cannot afford to attend UW-

Madison,” Martin wrote. “Our goal is to balance access and affordability with the preservation of

the university’s quality. The value of students’ degrees depends on the stature of the university.”

So what about non-resident students stuck in a circumstance similar to Proscia’s? Right now it

does not seem like financial aid for out-of-state students will become more accessible.

Proscia said she knew from the beginning the amount of money she was going to owe, but she

loved UW too much to forgo the opportunity to be a student there. But attending the university,

then moving away, makes her situation much more difficult.

“I am missing out on a lot of opportunities,” Proscia said. “I know why I was at UW, and I now

know what I’m missing out on.”