A new biotech company, Exact Sciences, is on the radar, not for their innovative product, but for the recent proposal to move their headquarters downtown to Judge Doyle Square.

Although the development is expected to increase growth in Madison, I am skeptical about the city’s investment in the endeavor.

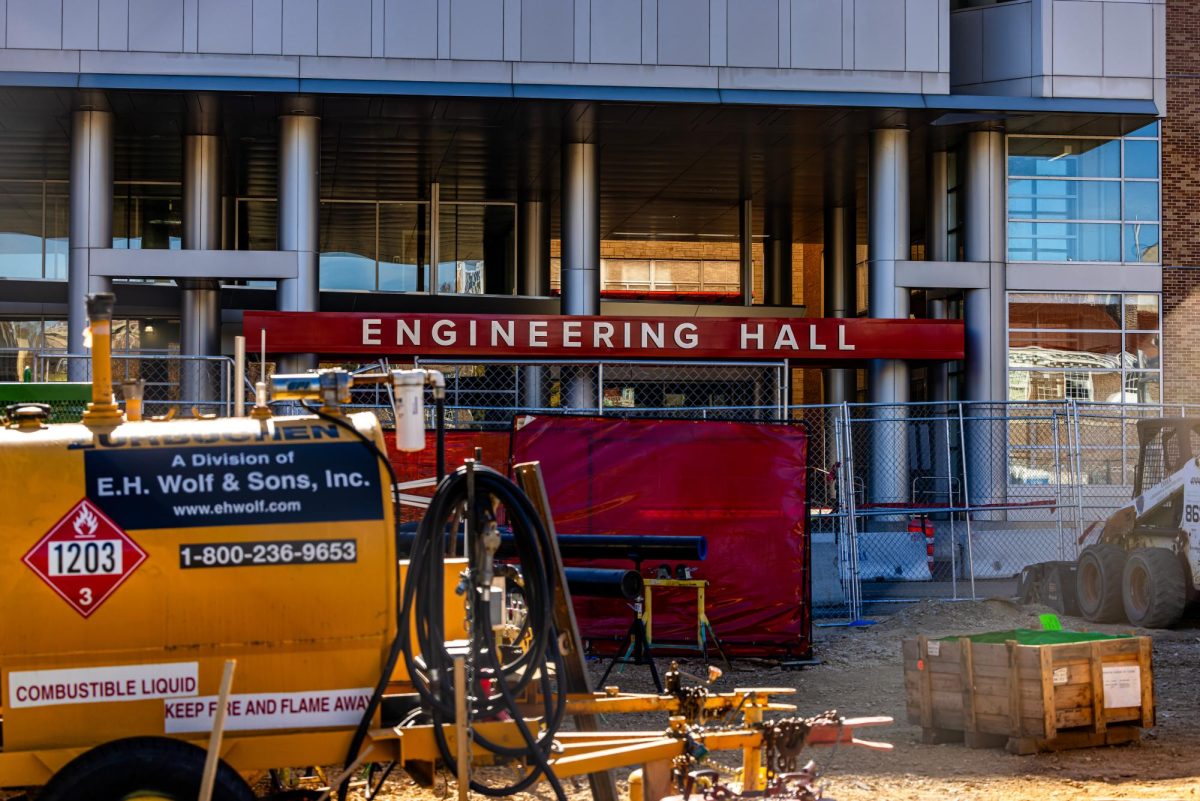

Years in the making, nearing completion, Judge Doyle Square project set back two weeks

The timeline for finalizing the agreement with the developer is rushed, and I believe the City Council needs more time to deliberate and incorporate public opinion into their decision.

The two-block area located between the Capitol Square and the Monona Terrace will be known as Judge Doyle Square. It has been the subject of a $200 million development proposal to build 1,550 parking stalls, a new hotel, a retail center and the Exact Sciences headquarters.

This is a relatively young company responsible for the development of the first FDA-approved non-invasive colon cancer screening test, known as Cologuard.

The decision to move the headquarters downtown is a massive project. It is sure to create jobs and accelerate economic growth, especially considering the trend of post-graduate exodus in Wisconsin.

Here’s the contentious part: the city of Madison has agreed to grant $12 million to Exact Sciences in a jobs-based tax incremental financing (TIF) loan.

A TIF loan is a way for the city to encourage community-development projects by subsidizing companies to expand.

With the increase in revenue from property and sales tax, the city can benefit from the economic development and use the tax base to pay for improvements in areas such as Madison, Dane County, Madison College and Madison school districts.

They estimate the city will recoup their investment in about six to seven years, bringing an estimated $10 million per year from property, sales and hotel taxes.

The proposal has recently been recommended for approval by the Board of Estimates if issues, including this TIF proposal, are resolved.

The concern many have with the TIF loans, and the root of my skepticism, is it is unclear if the $12 million loan to Exact Sciences is worth the cost.

The loan is contingent on the creation of 300 jobs in the Judge Doyle Square location by July 2017, and another 100 jobs by 2019.

Portions of the money will be returned if job growth expectations are not met or Exact Sciences leaves the location before an agreed period of time.

According to the Capital Times, TIF Coordinator Joe Gromacki says the loan violates 13 provisions of the TIF policy and acts essentially as a grant, with the money not being directly paid back, but instead received through tax payments until 2045.

It’s also not specified what Exact Sciences will use the loan for, as certain sources of expenditure are illegal under state law.

The city is largely funding this huge project through the surplus from the tax incremental district (TID), where Judge Doyle Square is located. But many feel the district should be closed and the reserve tax money be used by other bodies, such as the public schools, resulting in a rejection of the proposal.

While I don’t think the deal should be outright terminated, funding the expansion of a company with an unclear understanding of what Exact Sciences will do with that money is cause for hesitation.

But another facet to consider is that Exact Sciences bought land in University Research Park for $4.8 million, where another TIF district is proposed. If Exact Sciences plans to maintain their headquarters in Madison, despite the Judge Doyle deal, why is the city rushing into an agreement to abundantly subsidize the project?

Mayor Soglin asserts the need to revive Madison justifies the risks the loan may come with. But he has recommended a delay in the City Council vote until Sept. 15.

Years in the making, nearing completion, Judge Doyle Square project set back two weeks

Though I understand the need for investment in growing businesses in the Madison area, I don’t understand the need to rush negotiating parties and the City Council to reach a decision for a proposal with such an enormous price tag.

Yes, risks must be taken in order to reap rewards, but a poorly informed investment of such an exorbitant amount is simply foolish.

Megan Stefkovich ([email protected]) is a sophomore majoring in biology.