While Wall Street investors are frantically dumping their nose-diving stocks and panicky homeowners are watching house values plummet, some experts say most Wisconsin residents can take a deep breath and relax.

According to local economists, the slump in the U.S. economy will take only a mild toll on Wisconsin and an even milder toll on Madison. In fact, some local industries may actually see profits on the rise.

“Madison is sort of an insulated place buffered by the government and a large student population that demands rental housing, so it’s not that serious here,” said Don Hester, a University of Wisconsin economics professor emeritus. “Madison will experience a mild recession, and Wisconsin as a state … my guess is that it will also experience a rather mild recession.”

Because the slowdown has remained somewhat concentrated in the housing market and related industries, Wisconsin may be especially sheltered from the disarray, according to Dennis Winters, chief economist for the Wisconsin Department of Workforce Development.

“It certainly is going to be affected, but I don’t think it will be as severely impacted as the nation as a whole or some other states with high housing exposure, such as California or Florida,” Winters said. “We don’t have as much risk exposure.”

Real estate in Madison today looks healthy compared to most other places in the country, Hester said. While home prices here are falling 5 to 10 percent, prices in places like Cleveland, Detroit, California and Florida are dropping nearly 40 percent.

Yet even the nation as a whole should be more comfortable than it has been throughout the last few economic slowdowns, according to Steve Rick, senior economist for the Credit Union National Association and a UW economics lecturer.

“The 2008-09 economic slowdown will be mild compared to the last three recessions because of a number of factors,” Rick said in an e-mail to The Badger Herald. “Robust productivity growth through 2007 and 2008 reflects strong economic fundamentals as businesses continue to invest in new technology and adapt evermore efficient operating methods.”

Additionally, Rick said because this recession was not caused by excess inventory levels or an overbuilt commercial property market, most of the economic adjustment will come in the form of lower asset prices rather than lower economic activity.

“The economy should be out of recession sometime in late 2008 or early 2009,” he said.

Loans, jobs and automobiles

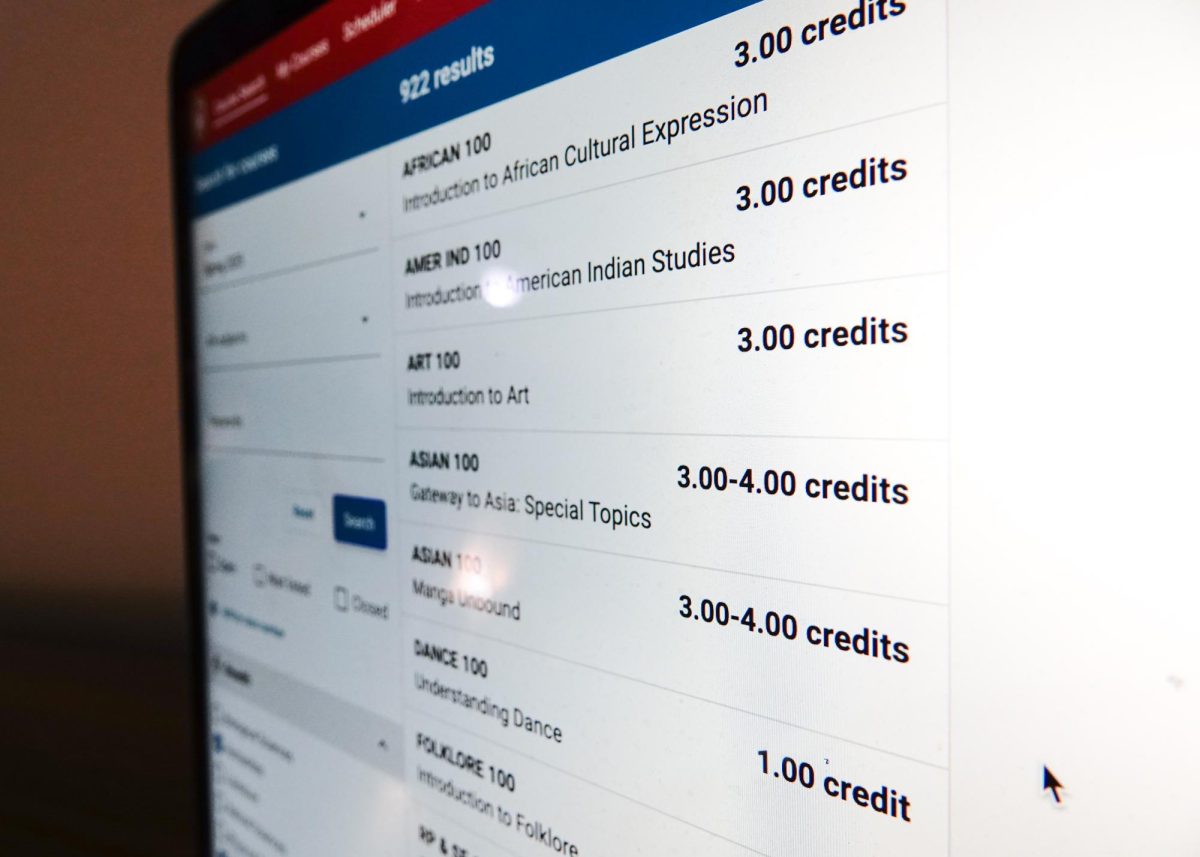

While the overall economic landscape may not be as bleak as some feared, the slowdown will nonetheless have many notable repercussions. And those affected will most likely include many people at UW.

“The UW budget is in dire straits already because the governor underestimated his revenue by something like $400 million, so that means that all agencies are going to have to take some kind of a cutback,” Hester said. “I think that the university will end up suffering, both in terms of students’ ability to finance their positions and in terms of the university’s ability to fund staff.”

Hester said the economics and political science departments have already lost several valuable professors to schools who are in better shape financially, and he guesses other departments are finding themselves in similar situations.

“Private universities are beating us into the ground,” Hester said. “It’s difficult to hire when other universities are paying more and they’re able to provide their support for faculty.”

Yet the weakening labor market may deal the biggest blow to UW students, especially those approaching graduation, according to Rick. The U.S. Department of Labor reported Friday that 80,000 jobs disappeared in March throughout the country, which follows significant losses in previous months as well.

Although Rick expects the economy to be on its feet again by late 2008 or early 2009, he said the job market may not rebound quite as quickly.

“Firms are historically slow to hire after a recession, preferring to increase the productivity of current workers. So I expect the unemployment rate to keep rising through 2009,” Rick said in an e-mail.

The prospects for financial aid, however, look less dismal. Mike Long, vice president of lending for the UW Credit Union, said he doesn’t foresee any problems for students trying to get federally subsidized loans.

“Although there’s been a slight contraction, I still think there’s going to be enough money to lend,” Long said, adding that he doubts the government would reduce the number of loans offered to students because for politicians, cutting student loans is not a popular move. “Nobody wants to be on the side of getting in the way of a student getting an education.”

Susan Fischer, director of the UW Office of Student Financial Services, said the only repercussion of the slowdown she has observed thus far in terms of financial aid has been that some private lenders of subsidized loans have dropped out of the business because it was no longer profitable for them.

“Some students will have to look for new lenders,” Fischer said. “But I believe there are still enough lenders out there.”

Considering college students likely don’t have to worry too much about the declining value of homes or pension plans, Long said it actually may not be a bad time to be a student.

“From a purely financial standpoint, interest rates are low, and those are the things that [college students] are looking for from a financial institution at that point in their life,” Long said.

Nonetheless, with the current higher standards for obtaining loans, Long said it is critical for students to start working on establishing favorable credit ratings so they can buy the cars, homes and electronic toys they’ve had their eyes on upon graduation.

“It’s always good to start establishing good credit, and it’s even more important today. Because of all the sins of all the mortgage brokers, it’s becoming more difficult for students to get loans for homes,” Long said. “This is probably one of the lessons that needs to be taught at this point: that good credit is essential.”

The good news

Although the economic slowdown is bad news for most, several industries in Wisconsin are actually thriving from current economic conditions.

“Wisconsin, curiously enough, is a major exporting area … and the collapsing dollar will mean that we’re more competitive in Europe and the rest of the world,” Hester said.

Wisconsin exports already increased by 12 percent in 2007, and industrial and electrical machinery exports have risen 80 percent since 2002, according to Winters.

Rising exports combined with strong overseas economic growth will keep many U.S. industries healthy, Rick said, which may help contain the current slowdown and keep the economy from falling to the depths it has in recent recessions.

The agricultural sector in Wisconsin has also seen profits on the rise recently as a result of high food prices.

“Agriculture, even though expenses are going up because of energy, is heading into a really terrific market,” Hester said. “Food prices have gone up about fourfold in the last year.”

According to a spokesperson for the Wisconsin Department of Agriculture, Trade, and Consumer Protection, the overall economic downturn has yet to hit Wisconsin agriculture, as high prices and low interest rates have kept the industry prospering.

The Wisconsin tourist industry may also see a boost in profits in the coming years due to current economic factors, according to Hester.

“The collapsing dollar may actually help the Wisconsin tourist industry because people aren’t going to be able to afford to fly, aren’t going to be able to afford Europe,” Hester said.

Yet the collapsing dollar, he said, which has caused oil prices to rise, will inevitably affect everything that requires energy use.

“All those things are going to hurt the state some,” Hester said. “And it will also affect the demand from large manufacturing firms in Wisconsin. Wisconsin is still an industrial state.”