Its supporters say it will force legislators to be fiscally responsible and be accountable. Its detractors say it will deleteriously affect the state of Wisconsin so much so that even the state's largest economic engine, the University of Wisconsin, could become privatized or worse.

One thing is for sure — the state's proposed Taxpayer Protection Amendment is set to be one of the most important and controversial issues state voters will decide on in a future referendum.

The TPA, co-authored by Wisconsin Sen. Glenn Grothman, R-West Bend, and Rep. Jeff Wood, R-Chippewa Falls, is based largely on the Taxpayer Bill of Rights (TABOR) first passed in Colorado in 1992. Despite its revolutionary attempt to return money to the pockets of taxpayers, Colorado's move largely failed according to a study released last week by the Economic Policy Institute. Additionally, in November 2005, Colorado suspended the tax caps for five years.

How the amendment works

Put simply, the TPA is a constitutional amendment that would place restrictions on the amount of revenue the state could gather based on a specific formula. Since the TPA is a constitutional amendment, taxes could only be raised through a pubic referendum. Currently, tuition and other student fees are not considered part of "revenue," which the state can regulate.

In addition, the formula used to adjust taxes for inflation would be based on the Consumer Price Index, a method to measure the changes in the prices of common goods.

According to Andrew Reschovsky, a professor in the UW La Follette School of Public Affairs, the amendment would control the revenue of the state government, special districts, county government and technical college districts.

The TPA also provides for a "rainy day fund," such as when the state experiences a good fiscal year, money would be put aside to help stabilize the economy for possible poor future fiscal years.

How some say it could help

Both Grothman and Wood argue the TPA would aid the state by reducing taxes and shrinking the state government. In effect, the amendment should hold legislators accountable for not overspending or spending recklessly since their funds would be far more strictly regulated.

Many groups around the state have rallied around Grothman and Wood's call for fiscal responsibility, including both Wisconsin Manufacturers and Commerce, and the Americans for Prosperity Foundation-Wisconsin Chapter.

"The amendment lets taxpayers keep more of their own money while allowing tax collections for all levels of government to increase every single year into the future," said WMC president James S. Haney, in a release. "This is a fair and reasonable proposal that helps cut taxes, grow the economy and provides government with the funds needed to provide vital services."

Haney also noted that Wisconsin had the fifth highest state and local taxes in the nation based on ability to pay.

The government is currently spending and borrowing more than it should be, said APF associate state director Lorri Pickens.

"When times are tough, you buy macaroni and cheese; when times are better, you buy the filet mignon," Pickens said. "Currently, the state doesn't live within its means; it's spending more than it has."

How some say it could hurt

While the TPA aims to protect taxpayers from excessive spending on the part of legislators, many worry about the severe long-term implications the amendment could have on a slew of government and private organizations, especially the UW System.

After hearing from Reschovsky, Grothman and Wood's aide, the UW Board of Regents chose to officially take a stance against the TPA last week, arguing it would force the university to either raise tuition or drop enrollment as well as significantly lower the amount financial aid provided to students.

"I believe it's going to be particularly hard for low and moderate income families," said UW Regent Charles Pruitt. "You get this double whammy of increased tuition and less money for financial aid."

However, Pruitt argued these three factors would also be accompanied by a significant reduction in the quality of education that could be provided to students and families.

Regents were incensed by the legislators' desire to cripple what they called "the state's largest economic engine."

UW System president Kevin Reilly and Regents have argued repeatedly that increasing the number of baccalaureate degree holders in the state would increase the standard of living, the amount of money in the tax base and the number of high-paying jobs and would also realign the state on a path to success.

Nonetheless many legislators argue UW alumni choose to leave the state after they graduate in what has been classified as a "brain drain."

However, Pruitt said evidence points the opposite with 75 to 85 percent of alumni staying in Wisconsin.

"Many people get out of college and start exploring," Reschovsky said. "In their 30s, a lot of people move back, lot of people grow up and get skills and when they think about it, 'I just got married, now where do I want to live?' It appears at least some number are coming back to Wisconsin."

Reschovsky added that if the state could not continue to invest in good schools and good infrastructure, then the prospects of long-term growth would be diminished.

The possible hammering to the UW System comes in a period of severe reductions in state support. The Wisconsin Alumni Association has found that while the state provided 14 percent of the UW-Madison budget in the 2004-2005 budget, it provided 25 percent only a decade earlier.

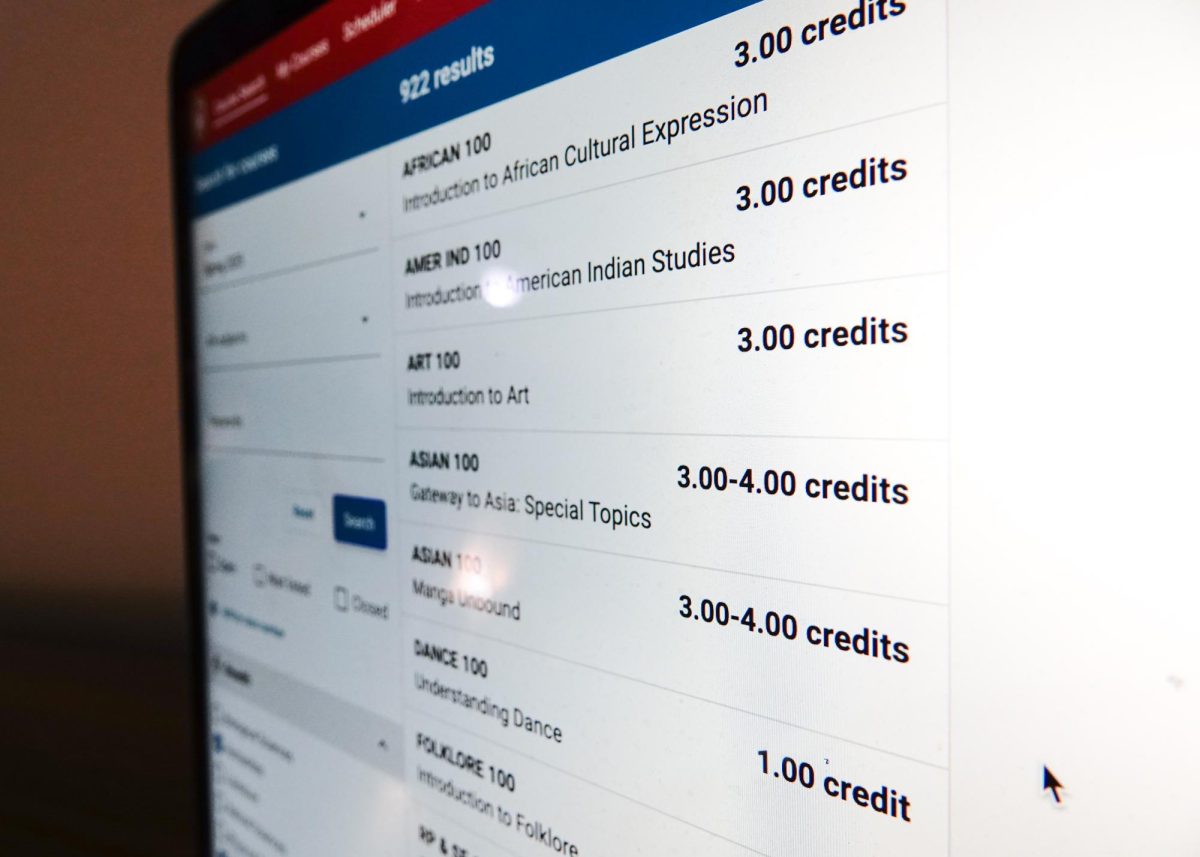

In the last biennium alone, UW-Madison cut over 250 positions and 300 course offerings. The UW System also cut and consolidated roughly 200 administrative positions.

"History shows us in difficult fiscal times that legislators and governors are quick to cut the UW system," said UW Council spokesperson Brian Tanner.

Tanner added that if the amendment passes the UW Council will be forced to request that it include tuitions and fees as part of "revenue," which is regulated by the TPA, so as to add some protections.

"Right now the phrase we use is [low income] students and their families are being thrown under the bus for the proposal because tuition and fees aren't included," Tanner said. "But if you throw in tuition and fees, you're throwing everyone under the bus."

However, Perkins said she considered the regents' response a "scare tactic" and said UW could probably afford further cuts without increasing tuition or dropping enrollment.

"It could increase in tuition costs, but as things become more expensive, taxpayers shouldn't have to pay it, the user should," Perkins said.

Privatization?

As state support continues to decline, UW administrators, and campus and community members worry the university may soon only be held up by private donations and gifts, something many at the UW have called the "privatization" of the university.

In addition, low- and middle-income students will be kept out of quality institutions due to high prices.

Continued raised tuition, dropping support and now the possibility of the TPA threaten to damage the "public" in public university.

"The [TPA] would force us to work more on private gifts grants and tuition," Tanner said. "Essentially it would privatize the UW, our state's only public university system."

In a March 6 memo to Rechovsky and the regents, UW chancellor John Wiley said evidence of Madison's degradation was already apparent with departments reporting loss of key faculty, research funding and the lowest average faculty salary for its 13-member, peer group including University of California-Berkley, University of Illinois-Urbana, University of Michigan-Ann Arbor and University of Texas-Austin.

According to Wiley, the implementation of TPA would be a "nail in the coffin."

"What I'm telling you today is that all this is now at serious risk, and the risk is not just 'out there in the future.' It is on us today," Wiley said in his memo. "If not reversed quickly, this situation will be educationally and economically disastrous for Wisconsin. If the Taxpayer Protection Amendment is enacted, reversal won't even be remotely possible."