College can be overwhelming at times. From tests to time management, from dorm life to drinking culture, there’s a lot to navigate — and money management is just one more obstacle to tackle.

Tips for saving money float all over the internet, but sometimes looking for information about money management can be more stressful than the task itself. According to The Ohio State University’s Study on Collegiate Financial Wellness, more than two-thirds of college students report feeling stress when it comes to personal finance. And it’s no wonder — there are a lot of factors to consider when thinking about how to save and manage your money.

It doesn’t have to be this way. What it all boils down to is creating a reasonable budget and sticking to it.

Many experts suggest tips for maximizing financial aid, paying off loan interest while still in school and building creditworthiness. But even reading about those things can feel overwhelming. Keep it simple. Here are a few tips for living on a budget that may help simplify the process.

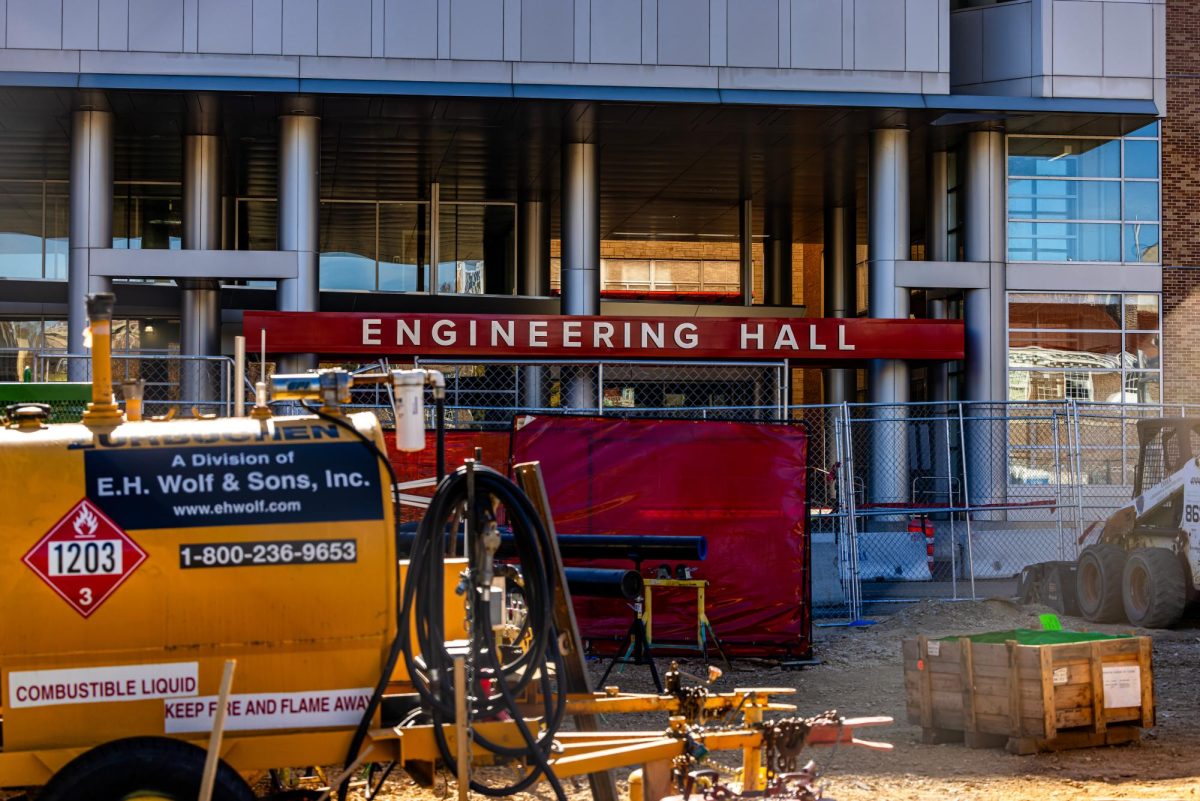

New financial aid director hopes to make paying for college easier

Create a budget based on income

For those new to budgeting, Forbes suggests using the 50-20-30 rule: 50 percent of your monthly income should go toward living expenses (rent, utilities, groceries, transportation), 20 percent of your income should go toward savings goals, and 30 percent can go toward flexible spending.

In short, use your income as the foundation for your budget, whether that means a full 40-hour work week or a 6-hour per week part-time job. Creating a budget will help you to gain a greater understanding of your spending habits will help you when you need to construct a more complex budget moving forward.

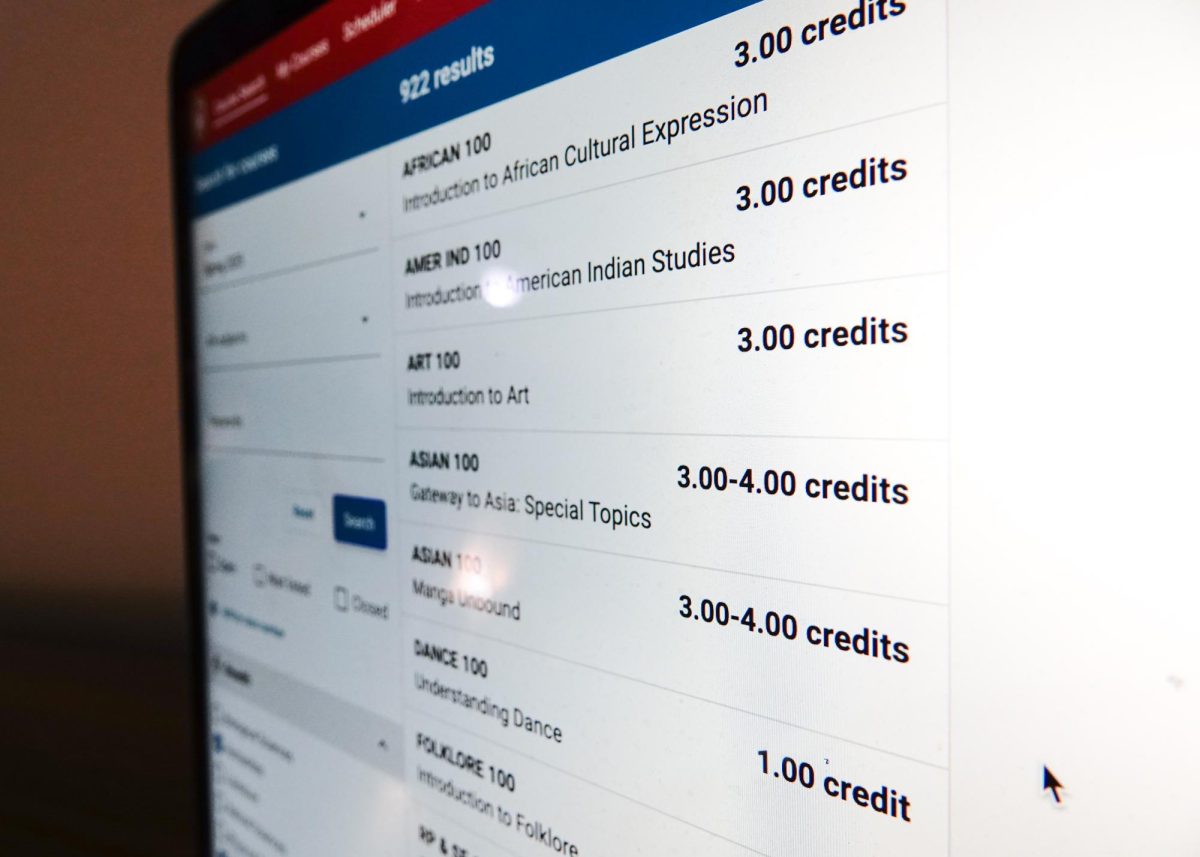

Maximize on the advantages of being a student

Paying tuition doesn’t just cover the cost to attend class — there’s a lot included in the ever-controversial segregated fees that many students don’t maximize. For example, all UW students can get a bus pass from Union South, which allows you to ride all city of Madison buses for free. Utilize the university’s athletic facilities before splurging on a membership at Anytime or Cyc. Take advantage of all the free food events hosted by different clubs and student orgs — it might not seem like a lot, but those free dinners add up. Ask about student discounts everywhere you go — you’ll be surprised how many places offer deals. Being a student comes with a lot of unexpected expenses, but it also comes with some unexpected perks.

Students must maintain involvement in fight to protect segregated fees

Reduce, reuse, recycle

Find ways to cut spending while reducing consumption and helping the environment. Ten times out of 10, renting textbooks or buying used textbooks will be cheaper than buying new. Thrifting clothes from places like Dig & Save and St. Vincent’s is inexpensive, and can be fun, too. Finding fun ways to use leftovers from a restaurant can stretch one expensive dinner out into multiple meals. When you want to go out and buy new things for your room or apartment, first look for ways to maximize what you already have.

As climate change becomes reality, UW students must reevaluate wasteful lifestyles

Stay on top of tracking your spending

We all know the feeling — the feeling of dread as you log into your bank account, not quite sure what the number will say, but knowing that it will be lower than you want it to be. Regularly checking in on your bank account, making sure you’re receiving any paychecks without issue, and keeping a detailed record of how you spend your money will force you to make more conscious spending choices. Remember — a budget means nothing if you don’t stick to it.

Focus on the big picture

Money management can be stressful and overwhelming, and we are all bound to make mistakes. If you accidentally spent a little too much on your fall wardrobe update, or buy one too many lattes in a week with a lot of midterms, don’t beat yourself up — you are bound to make mistakes, just as with every single other obstacle you will face in college. But the best way to improve your money management skills is to try, fail and learn from your mistakes.

Cait Gibbons ([email protected]) is a junior majoring in math with a certificate in Chinese