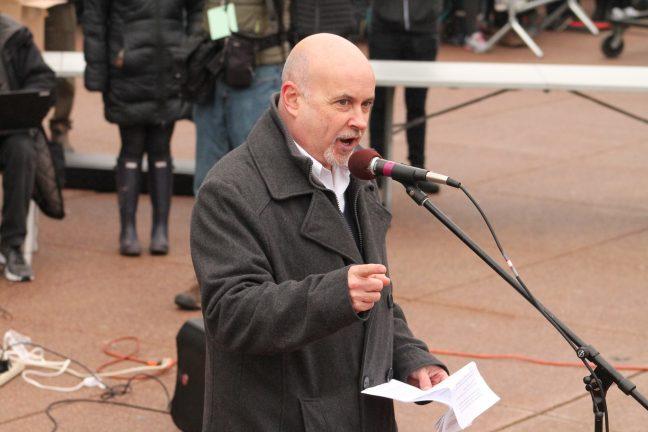

In an effort to increase college affordability, U.S. Rep. Mark Pocan introduced Tuesday the first bipartisan bill in the Trump Administration which would allows students to refinance their college loans at lower costs.

Titled the Student Loan Refinancing Act, the Madison Democrat’s bill would allow students to refinance their student loans whenever a lower interest rate becomes available.

According to a CNN report, the average amount of debt an undergraduate student faces is $30,100. More than $1.3 trillion in student loan debt is owed acrid 38 million students in the United States, making it the highest form of personal debt in the country.

Randi Weingarten, president of the American Federation of Teachers, said in a news release the bill will be a “financial relief” for millions of students and families.

“With college debt skyrocketing, Congress should be doing everything it can to help reduce the crushing burden of student debt,” Pocan said in a news release.

The Student Loan Refinancing Act will act as a mortgage or car loan. If a lower interest rate becomes available, then that is the interest rate that will apply for further payments rather than the student having to continue to pay the higher rate.

Scott Ross, executive director at One Wisconsin Now, said in a news release allowing students to refinance their loans in a system that’s “rigged against them” gives them a “shot at their piece of the American Dream.”

This act is more important now more than ever, Weingarten said.

Last week, President Donald Trump introduced a budget proposal that would reduce several federal aid grants. While the Pell Grant will remain, its funds would be reduced by $3.9 billion.

The bipartisan bill is currently cosponsored by dozens of Democrats, including U.S Rep. Ron Kind, D-La Crosse.