With the help of Ascendium Education Group’s recent $2.5 million donation, the Urban League of Greater Madison is now just $3 million shy of its goal of $25.5 million for the funding of their new Black Business Hub, according to the Cap Times. Ascendium, a long-time partner of the Urban League, is a non-profit with a mission of expanding access for post-secondary school education and training.

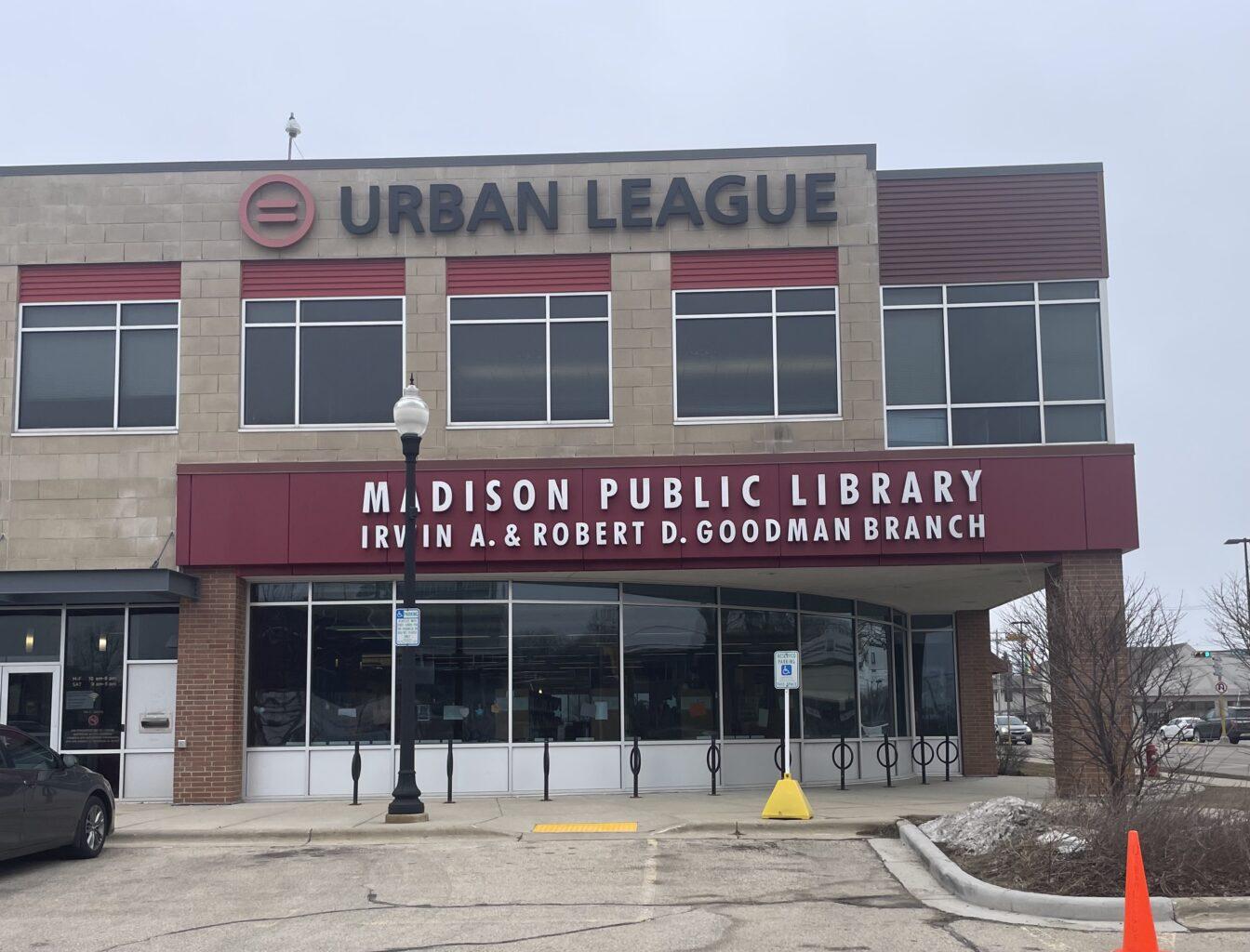

The Black Business Hub is currently under construction on South Park Street. Set to open later this spring, the Hub will offer training, financial support and professional networks for local Black entrepreneurs and businesses. The Hub will also have office spaces, storefronts and a commercial kitchen.

In a statement to the Wisconsin State Journal, CEO of Urban League of Greater Madison Ruben Anthony said the Hub will help contribute to economic equity by providing various resources and pathways to success.

Though Madison often holds a reputation as a progressive city, this label is somewhat misleading in context of its economic statistics by race. The Hub’s race-conscious approach to entrepreneurial support seeks to remedy a long history of economic discrimination in Madison.

The city’s racist redlining practices in the 1930s — a systematic process of evaluating neighborhood’s desirability based largely on racial demographics — determined the level of investment in the form of loans in Madison communities. Black communities were deemed undesirable and were therefore underinvested in.

The history of Madison’s redlining in the late 1930s is still highly correlated with present-day neighborhood maps and loan statistics by race in Madison, as laid out by former University of Wisconsin geography students in a research project.

According to Census data from 2017, “minority-owned” businesses made up under 7% of the total businesses in Madison. Considering the fact that almost 24% of Madison’s population is non-white, 7% is a disproportionately small figure.

The median household income for Black families was $39,800 in Dane County in 2021. In comparison, white household incomes were more than double at $82,300. The material impact of racial exclusion from Madison’s entrepreneurial scene is evident in Census data.

At a time when Black communities are still recovering from the outsized economic toll the pandemic took on them, the Black Business Hub’s services will be critical in building and rejuvenating the wealth of Black communities in the Madison area.

Empirically, Black-owned businesses fall behind white-owned businesses from the start. According to the Stanford Institute for Economic Policy Research, white-owned startups launch with $106,720 in capital on average, while the figure is only $35,205 for Black-owned startups.

Low household incomes and a severe lack of access to capital contribute to a vicious economic feedback loop that prevents Black communities from building generational wealth. With less surplus income to save, Black entrepreneurs have less money to start businesses, which perpetuates low-income levels as business ventures fail, stagnate or never begin in the first place due to a lack of financial support.

For Black-owned businesses that are able to get off the ground, securing loans presents another uphill battle. Accounting for factors like firm performance and characteristics, Black firms are less likely to be approved for financial support compared to white and Asian-owned businesses, according to the Federal Reserve.

The Black Business Hub’s partnership with Summit Credit Union addresses this racial disparity in access to business loans. Last spring, the CEO of Summit Credit Union announced that a new branch would open down the street from the Black Business Hub, according to the Wisconsin State Journal. The new branch is a physical symbol of the organization’s commitment to the success of Black-owned businesses.

Similar programs targeting the economic health of Black communities and businesses have proven very successful. In Connecticut, the Black Business Alliance has partnered with over 600 businesses to provide professional development, capital support and networks to Black-owned businesses in the state.

Given the barriers to success in business that Black entrepreneurs face, adopting a focused approach toward financial and other means of support is an essential step toward creating a more equitable economic environment in Madison. Growth of generational wealth in the Madison area’s Black communities, from the assistance of the Black Business Hub, will be profound in consequence.

Wealth is a huge barrier to educational outcomes. With higher levels of wealth in communities, public schools will see more investment and improved economic and social outcomes for students, according to the Organization for Economic Cooperation and Development.

Among young people from families in the top income quintile, they are more than one and a half times more likely to complete two or four years of college by 25 compared to those from the bottom income quintile, according to a study by the Urban Institute.

The success of Madison’s Black-owned businesses now and in the near future will have cascading impacts on future generations of Black youth in terms of social mobility and economic health.

The Black Business Hub and other organizations in the Madison area aimed at building wealth in Black communities represent a viable starting point for the economic growth and development that has been long overdue for Madison’s Black population.

Jack Rogers (jkrogers3@wisc.edu) is a freshman studying economics and Chinese.