Many students have never checked their credit scores, but they should! Your credit score comes into play in many aspects of your life.

When applying for a loan, a better credit score can get you a better interest rate and save you money. Landlords — and even employers — might check your score to ensure you are responsible with your finances before letting you sign a lease or a job offer. Credit scores can range between 300 and 850. Scores below 670 are generally fair or poor, and anything above is good or exceptional. There are many ways to check which range you are in and where the score came from.

Credit reports are provided by the three major credit bureaus — Equifax, TransUnion and Experian — and can be accessed for free once a year from each bureau, though they do not contain your actual credit score.

The data in the credit report is used to formulate your credit score, which is also commonly known as a FICO score, and can be obtained more easily from your credit card company, financial institution or a credit score service — usually free of charge. The credit report looks at five main criteria to determine your score.

Payment History — 35%

The most important factor in your credit score is payment history. Credit bureaus keep track of all of your credit card payments, checking that you pay at least the minimum amount required every month. Consistently missed payments will cause the largest drop in your credit score.

Amount of Credit Owed — 30%

Credit bureaus also care a great deal about how much credit you are using. Lines of credit include any credit cards and loans you have. Look at it like this — you don’t want to be using too much of the credit available to you. The general recommendation is that you use less than 30% of your available credit. So, for example, if your credit limit is $1,000 per month, only spend up to $300 on that one card. Raising your limits can help you lower the percentage of credit owed.

Length of Credit History — 15%

The longer you use credit and take out loans, the longer your credit history will be, which will ultimately improve your credit score. The bureaus look at the age of your oldest account, newest account and on average how long it’s been since an account has been used. Opening new accounts and closing old accounts will bring down your average credit age.

Credit Mix — 10%

The credit mix criteria looks at the types of credit you have. If you only have one credit card, that might be hurting your credit score. It can be beneficial to have various types of credit, like a few credit cards, student loans and a car loan, as long as you are being responsible with all of them.

New Credit — 10%

If you open a lot of credit cards at once or take out a large loan, it could show credit bureaus that you are struggling and need loans quickly, which makes you look riskier and hurts your score.

Practical tips you can implement today

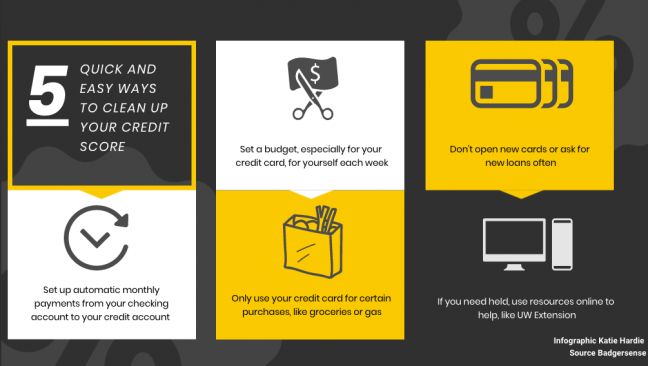

Now that you know the factors that are put into determining your credit score, there are many simple things you can do to tidy up your credit and improve your score. First, since payment history is the biggest factor, it is a good idea to set up automatic payments from your checking account for monthly credit card and loan payments. You won’t miss payments and can automatically pay in full to avoid excessive interest payments.

When it comes to the amount of credit owed, set a budget for yourself to spend each week, specifically for your credit card. Only using it for certain purchases, like groceries or gas, can help keep the amount owed small each month, while still building credit history. Additionally, don’t open new cards or get new loans too often, and consider the benefits of keeping an old account open, even if you aren’t using it, to lengthen your credit history.

There are plenty of resources online to figure out the best way to manage your credit cards and loans if you are unsure. University of Wisconsin – Extension even has a campaign to remind people to check their reports once a year and a guide on how to read the report. Now, go check your credit report and credit score, and make a plan to improve it!

Maddie Roamer is a senior majoring in personal finance. She is a peer educator with the Badger$ense Financial Life Skills Program in the School of Human Ecology. Learn about Badger$ense courses, workshops and other opportunities at sohe.wisc.edu/badgersense.