Colton Wickland, like an increasing number of college students in recent years, faces anxiety about how to pay for college.

When he was accepted into University of Wisconsin, Wickland knew his parents would not be able to support him financially.

“My parents don’t have any money,” Wickland said. “I wouldn’t say we’re financially bad-off or poor, but [we have] no funding left for college, no savings or anything like that.”

As a freshman, Wickland has taken initiative to try to support himself financially. He works at University Health Services as an undergraduate assistant for alcohol and drug prevention and also chairs the Green Fund of Associated Students of Madison.

But aside from his jobs, the need-based aid he receives and $7,000 in scholarships, he still needs to take out about $6,000 in student loans every year.

But he said getting a college degree is worth taking a risk with student loans. He works to help pay off his student debt, and through ASM, he actively helps other students who have similar, or even worse situations than him.

In 2013, even before coming to college, Wickland testified during the Senate hearing of a bill called “Higher Ed Lower Debt,” which would allow people in Wisconsin with student loan debts to refinance their loans at a lower interest rate.

Wickland expects to have $20,000 in loan debt by the time he graduates. In addition to his undergraduate debt, Wickland plans to attend medical school after graduation, which will probably cost him an additional $100,000.

“It definitely freaks me out, because if something goes wrong, then I’m basically done for,” Wickland said. “If I were to slip up and drop out of medical school or something, and I didn’t get a decent job, I would have student loans for the rest of my life basically.”

Loan debt realities

Wickland is far from the only student facing student loan debt worries. Many students face far higher costs. While Wickland expects $20,000 in loan debt by the time he graduates, the average debt of a UW graduate is $28,768, according to Michelle Curtis, UW’s Office of Student Financial Aid associate director. The national average in 2014 was $28,950, she said.

Wisconsin ranked third in the nation for number of college students graduating with student loan debt, with 70 percent of graduates having debt when they get out of college, according to a 2015 report by the Institute for College Access and Success.

According to UW’s 2014-15 Data Digest statistics, more than 50 percent of undergraduate students who graduated in 2013-14 carry loan debts at rates that have steadily increased between 2004 and 2015.

But financial aid has not been increasing as quickly as the cost of living, leaving students without enough support, Drew Anderson, postdoctoral researcher at the Wisconsin Harvesting Opportunities for Postsecondary Education Lab, said.

Therefore, a college education is also more challenging for low-income students to afford. Students from families with low incomes have lower rates of getting to college and lower rates of completing college, Anderson said.

As more students seek out a college education with cost-of-living expenses on the rise, the issue of college affordability continues to be a focal point for politicians.

Lawmakers’ efforts to address college affordability

Wisconsin legislators from both sides of the aisle have honed in on student debt in recent years, but Republican and Democratic policies vary greatly.

One of the most recent legislative efforts to make college more affordable is Gov. Scott Walker’s college affordability package, the majority of which is expected to be signed into law after it is voted on in the Senate March 15.

The package includes bills that would increase grants for technical schools, create an emergency grant program, give students tax deductions on interest, increase internship opportunities and provide students with financial literacy learning opportunities.

When the Assembly passed the bills Feb. 17, Walker said in a radio address they pushed Wisconsin one step closer to making college more affordable for students and his tuition freeze has already saved students an average of $6,311 per year.

“These proposals are a critical part of our work to lower the cost of higher education and ease the burden of student loan debt,” Walker said.

Rep. David Murphy, R-Greenville, said Walker’s college affordability package is just a start, and the student loan debt crisis is something that will continue to be addressed in the future.

“College affordability is something that needs constant work and really somebody keeping an eye on it, somebody really caring about what kind of shape our students are in going forward,” Murphy said.

But Rep. Katrina Shankland, D-Stevens Point, said Walker’s affordability package “doesn’t even scratch the surface” of the student loan debt crisis.

Throughout the past year, Democrats have proposed competing policies including ones that would allow students to refinance their loans, increase need-based aid and make the first 60 credits of college debt-free. None of the proposals made it through the Legislature this session.

Rep. Melissa Sargent, D-Madison, said student loan debt impacts Wisconsin’s future.

“We’re suffocating our next generation — our future leaders — with this crushing student loan debt,” Sargent said. “It’s hindering Wisconsin’s ability to grow economically, and it’s preventing graduates from realizing their dreams.”

Sargent said she hopes her plan for debt-free college, called the “Wisconsin Promise,” is able to make it through the Legislature next session, along with the student loan refinancing bill, “higher ed, lower debt.”

On campus resources

UW has some resources to help students navigate their loan debt situations.

The Office for Financial Aid is responsible for entrance and exit counseling for students with loans, Curtis said, with online tutorials and quizzes to guide them through the student loan process.

Curtis said there are other programs on campus that help reduce stress caused by student loans. A program called Financial Aid Security Track, or FASTrack, aims to provide security to students by offering them financial aid packages, ensuring they receive the same level of funding throughout their years of study.

Center of Educational Opportunity helps students achieve academic success, and teaches students how to manage their money and make budget and career plans.

She said students should take advantage of the benefits of federal loans, such as income-sensitive programs and forgiveness programs.

But not all students access or even know about these on-campus resources. Wickland admitted he has not sought assistance from them, and doesn’t even know what his student loan interest rates are.

ASM Chair Madison Laning said students need to be in the know and be responsible for their college funding plans.

Laning said many students who have loan debt lack information about getting loans, such as the consequences of loan debts moving forward in their college career. She said financial literacy is important for students to have before they take out large loans.

Loan debt versus the value of education

The impact of excessive student loan debt extends into all spheres of student life, such as personal spending habits, which could influence the economy in the years to come.

Wickland said his student loan debt will keep forcing him to be frugal for years after college, without the ability to purchase a house or a car. Even when he finds a job, a large portion of his salary will be used to pay for the debt that accumulated from funding his college education.

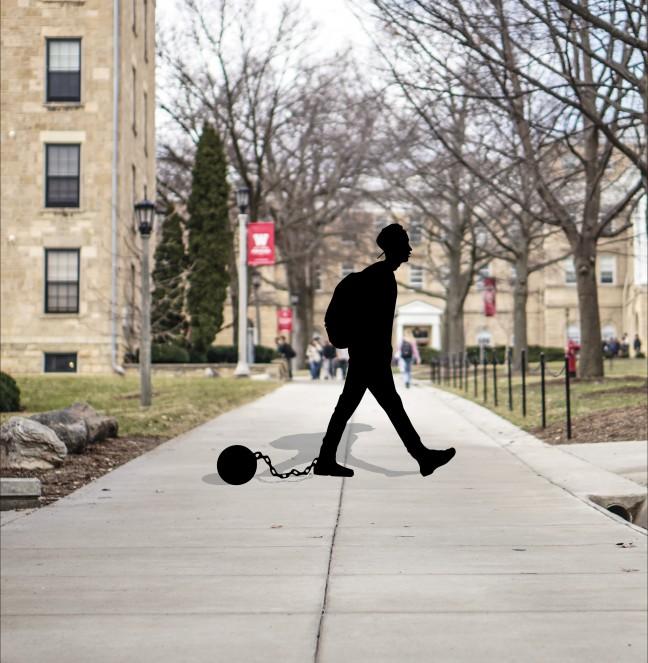

With this mounting debt, Wickland said he at times feels like he’s being punished for trying to better himself and society.

When students enter the workforce, Laning said, they will not be able to buy things like housing and cars that stimulate the economy.

She said UW needs to find more state funding, research money and donations instead of relying on tuition income to pay for the university’s needs.

“I think the number one issue is the rising cost of tuition, and it’s coupled with the rising cost of living, so I think our institution needs to find funding sources besides tuition, and keep the entire campus [from] running on the back of students,” Laning said.

Despite how daunting the expense of student loan debts can be, Curtis said the value of higher education makes it a worthwhile investment, and students need to be smart about their borrowing strategy.

“Looking ahead for the generation that’s borrowing right now, [they need] to borrow smart,” Curtis said. “If you don’t end up getting your education, or you’ve added years on to going to school because you didn’t want to borrow some student loans, I would argue that you’ve lost.”