Following the passage of a federal tax plan in the U.S. House of Representatives and Senate earlier last month, graduate students across the nation have expressed their concern over the affordability of postgraduate education under the bill’s provisions.

In what has been heralded as a considerable triumph for Senate Republicans and the President after earlier legislative failures, the Senate passed its version of the Tax Cuts and Jobs Act in early December.

This came shortly after the House of Representatives passed its version of the Act in mid-November. Soon, a Congressional joint committee will meet and attempt to rectify differences between the two bills.

While both plans include provisions which cut income tax rates, double the standard deduction and eliminate personal exemptions, the bills differ in their policy towards tuition remission for graduate students.

Most graduate students at public universities, including those at UW, receive tuition reductions and a monthly stipend for their work as teaching or research assistants. In the House’s tax reform bill, a section of the Internal Revenue Service code which exempts tuition remission for graduate students is eliminated, thus making it taxable income.

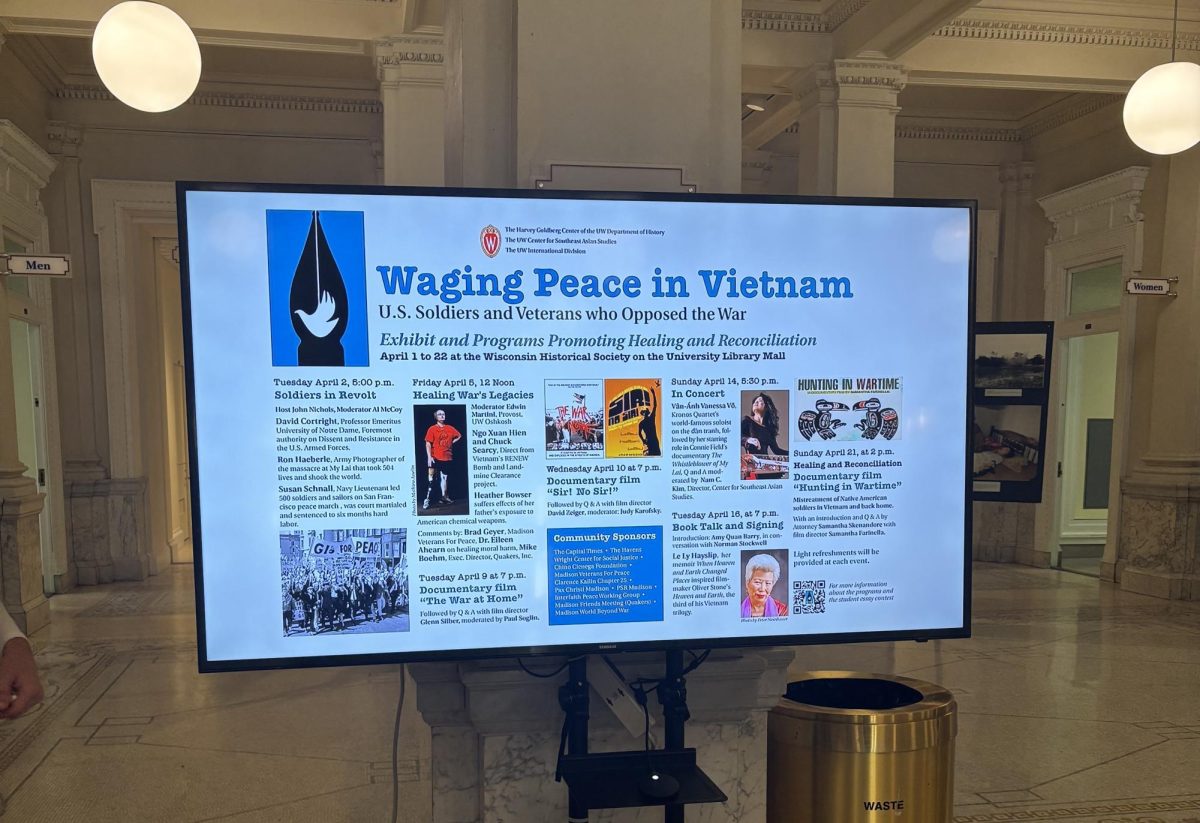

Student panel discusses effects of GOP tax bill on graduate students, college affordability

The House bill will also eliminate tax deductions for student loan interest, and both the House and Senate bills include an excise tax on private university endowments.

Many aspects of the two bills remain uncertain. Most importantly for graduate students, the policy on taxation as it relates to higher education has yet to be determined in the combined bill.

Making discounted tuition tax deductible will affect a large number of graduate students nationwide, including a considerable number on UW’s campus. According to an article in The Capital Times, approximately 5,300 PhD students and 1,900 master’s degree students receive this tax benefit at UW.

Expanding beyond UW, it is estimated that postsecondary education would be made unaffordable for more than 145,000 graduate students nationwide if this bill comes to pass.

Kelly Murray, a UW graduate art student, said she expects her income to rise dramatically if the bill should pass.

“From the numbers I have been hearing, my income tax will likely double or triple,” Murray said. “I don’t know where this money is going to come from.”

In wake of cuts to federal research funding, UW develops new research submission tool

Like many graduate students, Murray is a recipient of the tuition waiver and a monthly stipend of around $1,000 for her work as a teaching assistant. She also bartends and participates in UW’s work-study program, all while balancing her twelve credits.

Should the bill pass, Murray said she is concerned over how she will balance her responsibilities with school and work on top of the financial burden she believes the tax bill will place on her.

“My hope was to drop one of these side jobs to have more time for myself and for school, but with the new tax reform I am concerned where the money will come from,” Murray said.

UW political science graduate student Andrew McWard said the new bill will force graduate students to pay taxes which are higher than what students generally earn as income.

McWard said he is hesitant to pick up an extra job to compensate for this tax increase, as it further strains his already tight schedule.

“I already work roughly 60 hours a week, and it would be difficult to find extra time for another job,” McWard said. “Any additional time spent working is time taken away from working on research and dissertations.”

Lawmakers work to prevent expiration of federal student loan program

The UW administration has also responded to the bills, and is reaching out to Congressional representatives to advocate on behalf of both UW’s student and institutional interests.

In a letter to U.S. Senator Tammy Baldwin, D-Wisconsin, UW Chancellor Rebecca Blank outlined her concerns on the Senate bill.

“While the Senate bill does not include some of the more harmful provisions to students and families in the House version, the bill would nevertheless increase costs and regulatory burden on the University of Wisconsin,” Blank wrote.

In her letter, Blank said the new bill would impact the services and resources available to students and would inhibit UW’s ability to educate and train faculty and staff. She said provisions which would tax name and logo royalties, eliminate advance refunding bonds and increase the standard deduction, would cost the university millions of dollars annually.

UW public affairs and applied economics professor Andrew Reschovsky said the new tax bill would curtail state government spending, which he said will harm institutions like UW.

“The state of Wisconsin could end up raising less revenue than it otherwise would, which will put more pressure on tuition and result in less resources, less research opportunities, and the inability to support scientist and lab work,” Reschovsky said.

A number of universities across the U.S. have seen their graduate students protest the new bill. At UW, a petition against the new provisions related to graduate students was circulated by the Wisconsin Alumni Association.

Additionally, UW graduate students hosted a phone-bank at Bascom Hall earlier last month, in which attendees called Wisconsin’s Congressional delegation to express their opposition to the new tax reform bills. Earlier last week, a graduate student panel discussed the bill’s possible adverse effects on college students.

Murray said she hopes there will continue to be some kind of mobilization on the UW campus in dissent of the tax reform.

“This policy will keep students from pursuing higher education, and will create a disincentive for following their dreams,” she said. “I am worried for the state of our country.”