In additional to the candidate races, Madisonians will be able to cast a vote supporting or opposing the $26 million Madison Metropolitan School District operational budget on their Nov. 8 ballot.

The $26 million, spread over four years, would increase Madison Metropolitan School District’s revenue limit. A school district’s revenue limit, also called a levy limit, is the maximum amount of revenue that may be raised through state general aid and property taxes. The total amount the district could charge the state in 2015-16 was $281,158,559, according to the Wisconsin Department of Public Instruction.

Dane County Clerk Scott McDonell said the referendum would allow the district to increase Madison residents’ property taxes to pay for school programming and operations for the district’s 49 different schools.

“A lot of school districts around the state are having trouble paying their teachers, and some of the more wealthy districts are poaching teachers from one school district to another by being able to pay them more,” McDonell said.

The $26 million would be allocated over the next four years, with $5 million allowed in the next two years and $8 million the two years after that, McDonell said.

Though the increases would likely result in increased costs for renters, McDonell said increasing the levy limit would improve the quality of schools.

“That’s not a small amount of money, and it’s right here [in Madison]. It’ll mean, for [college] students, an increase in rent as the landlords will pass that cost down,” McDonell said. “In return, the idea would be that our [K-12] schools stay strong and that the overall value of the district is often linked to the quality of the schools.”

If the referendum is passed, the district could increase taxes for citizens as soon as December 2016. Madison Metropolitan School District predicts tax bills for the average home could rise by approximately $60 from 2016-17 to 2017-18, with an average annual impact of $35.76 for four years.

UW participates in national initiative to prepare students for election

McDonnell said the current limit accounts for inflation but doesn’t factor in health care and other increasing costs, which could result in more teacher layoffs and increased classroom sizes.

If the revenue limit was increased, the district’s priorities would be to continue to improving literacy rates, bring in more diverse staff and provide services for students with disabilities, English language learners and advanced learners, Madison Metropolitan School District Superintendent Jennifer Cheatham said.

In a community informational session at Memorial High School held Oct. 27, Cheatham said one of their main focuses is to close opportunity gaps among students.

Wisconsin is the number one state in the nation concerning the disparity of graduation rates between white and black students, according to data from the National Center for Education Statistics. Nearly 93 percent of white students graduated compared to only 64.1 percent of black students in 2014-15.

Schools in the district saw a 12 percent increase in literacy among African American students in one year, according to MMSD. Cheatham said early intervention programs funded by the increase could help continue this trend.

“We believe that we cannot let challenging state budgets put us in reactive mode,” Cheatham said. “We need to find efficiencies, repurpose funding and keep our efforts to improve achievement at the forefront.”

But attendees at the informational session raised concerns about how Madison residents could hold the district accountable for the increases in spending. They also questioned whether or not there will be more revenue increases in the future given that a $41 million referendum to fund construction was passed in April 2015.

Michael Barry, assistant superintendent of business services, said this referendum is different because it pays for programming and operations, not construction.

Concerning accountability, Cheatham said citizens will have to continue to stay engaged and the school board must focus on responsible spending that doesn’t necessarily hit the new limit.

Ed Hughes, a school board member, said the board wants to develop a budget that reflects the values of the community.

“The accountability is when you get your property tax bill and see how much it’s going up and get a sense of ‘Is this a worthwhile investment in our schools?'” Hughes said. “Are we seeing the kind of results that justify whatever level of increase there may be in your property tax bill?”

Federal, state government prepare to address fraud, discrimination on Election Day

Ballots around the state will include similar referenda to increase school levy limits, both to construct new schools and pay teachers, McDonell said.

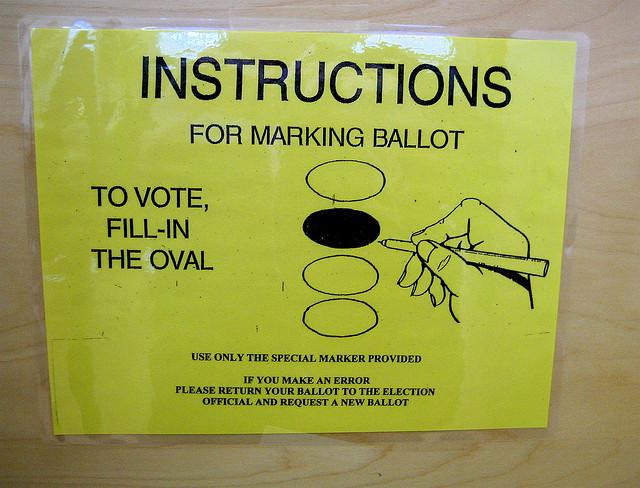

The decision to increase or not increase the levy limit will appear as a yes-or-no question on the back of the ballot. Sample ballots and information about how and where to vote are available online.

“A lot of times, the referendum issues will be more important for you day to day,” McDonell said. “These are things that are right in front of you, not a thousand miles away in [Washington,] D.C. They’re really important.”