Taxpayers are more willing to support the kindergarten through twelfth grade education systems, rather than funding for higher education, according to a new survey.

A new nationwide survey showing how taxpayers view fiscal priorities for state governments was released from the Pew Center for the States Thursday.

The survey was conducted in five states, including Arizona, California, Florida, Illinois and New York, according to a statement from the Pew Center.

These states together represent almost one-third of the U.S. population and roughly one-third of the nation’s economic output.

This is the first in-depth survey on how residents view their state’s budget problems during tough economic times, according to the report.

The survey showed the majority of taxpayers in all five states would be willing to pay higher taxes to keep K-12 public schools at current funding levels.

These states wouldn’t, however, pay higher taxes for higher education, the data shows.

According to the report, residents are on average 20 to 30 percent more willing to support funding for primary and secondary schools than higher education. It also said taxpayers are willing to pay more taxes for health and human services than higher education.

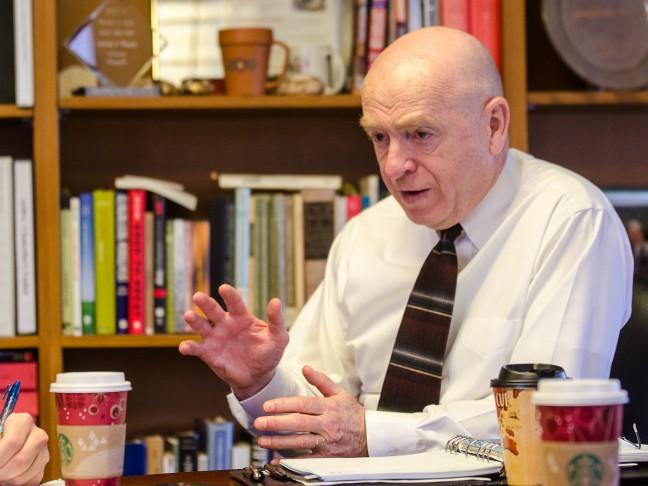

“This study doesn’t surprise me. There are many more people in the K-12 system than in higher education,” University of Wisconsin political science professor John Witte said.

Witte said taxpayers are more likely to have children or grandchildren in the K-12 age range, so they will be more willing to support those tax increases.

Public education is funded through local taxes and people see those taxes going to their local K-12 schools,” Dale Knapp, research director for the Wisconsin Taxpayer’s Alliance, said.

“The cost of higher education, however, has gone up dramatically, so people are reacting to that and are not willing to pay more taxes for those increases,” Knapp said.

Knapp also said colleges are receiving significantly less tax money from the public because taxpayers don’t associate their tax dollars going to higher education as much as K-12 education.

However, Knapp says the recent economic downturn has not had a great effect on education spending.

“States all over the country have made a commitment to public education, and it’s one of those services where the number of students doesn’t go down in bad times or up in good times. It’s independent of the economic times,” Knapp said.

Knapp said funding for education must continue at some level, regardless of the economy. He added government can always look for more efficient ways to pay for education.

Witte said UW does not receive much aid from state taxes. The state only supports higher education at UW by paying 23 percent of the university’s operating costs.

Although higher education programs annually receive less money than K-12 schools, UW is not experiencing tax cuts, Witte said.

“I think cuts will come in the future and I think the K-12 system is going to take a hit too, because they’re even bigger than we are,” Witte said.